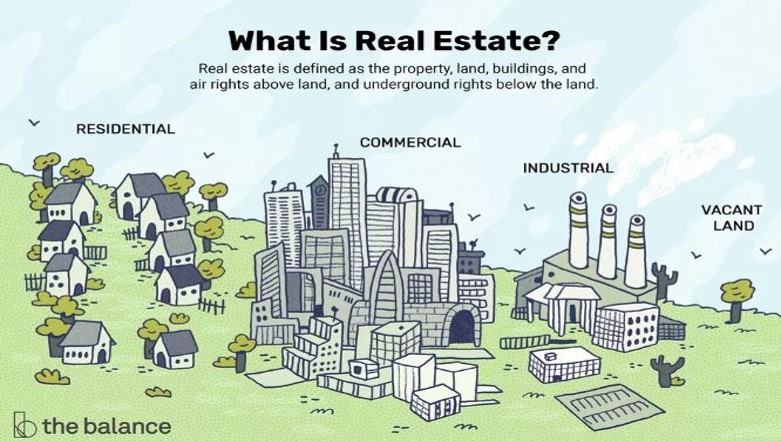

What is Real Estate?

What is Real Estate?

Real estate is a property, land, or building along with its natural resources including water, crops, livestock, and mineral deposits.

The term real estate means ‘real’ or physical, property. “Real” comes from the Latin root res, or ‘things’ other says from the rex meaning ‘royal’.

Real estate is considered as a tangible asset and a type of real property. Real property include land, buildings, and other improvements, plus the rights of use and enjoyment of that land and all its improvements.

Residential real estate is less costly and more realistic for individuals when it comes to investing, whereas commercial real estate is more expensive and more secure. In general, real estate provides income and capital appreciation as an investment.

4 Types of Real Estate

- Residential real estate includes both new construction and resale homes. Houses, condominiums, and townhouses are the most popular. The buildings may be single-family or multi-family homes and may be owner-occupied or rental properties.

- Commercial real estate includes non-residential structures such as office buildings, warehouses, retail buildings. Apartment buildings are also often considered commercial, even though they are used for housing. That’s because they are owned to generate revenue.

- Industrial real estate includes factories, business parks, warehouses, mines, and farms. These properties are usually larger in size and locations may include access to transportation hubs for distribution. It is worth mentioning that some buildings that distribute goods are considered commercial real estate. The classification is important because the zoning, construction, and sales are handled differently.

- Land includes vacant land, working farms, and ranches. The subcategories within vacant land include undeveloped, early development or reuse, subdivision and site assembly.

Investing in Real Estate

You may invest directly in real estate by buying land or property, or you may choose to invest indirectly through buying shares in public traded real estate investment trusts or mortgage-backed securities. Investing directly in real estate results in profits or losses in two ways that have not changed throughout the centuries; rental or lease income, and appreciation of the real estate’s value.

Pros

- Offers steady income.

- Offers capital appreciation.

- Diversifies portfolio.

- Can be bought with leverage.

- Numerous tax benefits.

Cons

- Is usually illiquid.

- Influenced by highly local factors.

- Requires big initial capital outlay.

- May require active management, expertise.

Why Real Estate is a Great Investment

Remember the simple acronym that real estate investing is I.D.E.A.L.

- INCOME in real estate comes in many forms; however, the biggest generator is the concept of rent payments on the property. As rent is paid each month, and that monthly income flows to the owner.

- DEPRECIATION is an accounting method that allows you to deduct the value of an asset over its useful life. The magic of Real Estate is that you get to depreciate the value of the property, but overtime, Real Estate values will always tend to increase.

- EQUITY is ownership of assets that may have debts or other liabilities attached to them. When a mortgage is paid, a part of it goes toward paying interest on the loan and the other part is for paying the principal value of the property. If you have the property rented, rentals will cover for the mortgage, repairs, maintenance and more.

- APPRECIATION is the increase in property value caused by other factors than the build-up; including inflation, improvements to the property such as discovering valuable materials or natural resources on the land and rise in the market values caused by development around the area; as a neighborhood grows and develops, property values tend to climb up. This is being evaluated as the property’s potential.

- LEVERAGE is the concept of paying for something without coming up with the full cost, while enjoying its capital appreciation. In real estate, leverage is used to a maximum advantage because the property is a tangible asset; it can capitalize on numerous revenue streams. There will always be a value in your land and value on the structure.

In conclusion, buying real estate is an investment strategy that can be both satisfying and lucrative; an investment that has the potential to provide a steady income and build wealth. However, it goes without saying that as with any other investment, each type of real estate investment has potential benefits and pitfalls. So, keep your expectations realistic, and make sure to study and research opportunities well before making any decisions.

Real Estate by James Chen, 25 September 2019 – www.Investopedia.com

Real Estate, What It Is and How It Works – Four Types of Real Estate by Kimberly Amadeo, December 14, 2019 – www.thebalance.com

The 5 Key Reasons Why Real Estate Investing is Awesome by Jared – www.capablewealth.com

Qatar Monthly Statistics of November 2019 Issue 70 based on the Planning & Statistics Authority